Net emissions by 2050: an unattainable goal?

Can the aviation industry achieve the zero carbon emissions target set by the International Air Transport Association (IATA) by 2050? Professor Keith Hayward, Fellow of the Royal Aeronautical Society, collects and compares the relevant evidence.

The International Air Transport Association (IATA) signed a commitment to achieve zero carbon emissions by 2050 at its 77th Annual General Meeting in October 2021.

This presents challenges for aircraft design, fuel infrastructure, business models, and the physical infrastructure of our air transportation system, but is it achievable?

Within the industry, opinions vary. Akbar Al Baker, former CEO of Qatar Airways, believes that the aviation industry's emission reduction targets are "a PR campaign" and that the industry will not be able to achieve its original 2030 carbon reduction targets, nor will it be able to achieve its 2050 zero carbon emissions target.

Meanwhile, Willie Walsh, director general of the International Air Transport Association, was more optimistic, but stressed that achieving these goals would be difficult and would require a lot of investment. Aviation is an industry that is difficult to reduce emissions, and the path to achieving the industry's ambitious 2050 zero emissions target is narrow and unclear.

Time is ticking

时不我待

Three years of intensive research covering the entire life cycle of an all-electric aircraft,Tecnam concludes in June 2023,The timing for its P-Volt project is "not yet ripe, although research activities will continue to explore new and emerging technologies" (Rolls-Royce)

However, we only have about 25 years to achieve IATA’s green goals. Technically, this is about the time it took the aviation industry to go from the first commercial jet to the production of high-bypass jet-powered wide-body aircraft.

The combination of aviation and green energy, coupled with deregulation, has ushered in an era of mass air travel and established a demand curve that moves in lockstep with world economic growth. All things being equal, this pattern is expected to continue indefinitely, supported by demand supported by economic growth in parts of the world that previously did not have large numbers of people flying for business or pleasure.

In terms of the resources needed to keep the current global fleet flying, total aviation fuel consumption in 2021 was 8 billion gallons, powering a global fleet of more than 25,000 aircraft worldwide.

Global orders for new aircraft totaling 40,000 over the next 20 years will result in a large number of conventionally powered passenger aircraft still in operation when aviation reaches its carbon neutrality target. By 2050, if all else remains constant, demand for jet fuel will more than double, reflecting forecasts showing fuel consumption growing much faster than any other transport sector.

To maintain emissions at current levels by 2050, fuel efficiency will need to double, while also using alternative fuels. Conservative estimates suggest this will require an additional $900 billion in investment over and above current R&D costs.

On a more positive note, emissions per passenger kilometre have fallen by 80% over the past 50 years, reflecting the dramatic change brought about by the innovations introduced in the late 1960s and early 1970s. At the same time, it is becoming increasingly difficult to squeeze more out of the existing technology base.

Sustainable aviation fuel

可持续航空燃油

Virgin Atlantic to fly 100% SAF flights across the Atlantic in 2023, first for large commercial airliners.(Virgin Atlantic)

Aircraft using SAF fuel will reduce carbon emissions, but there will still be net carbon emissions. In the best case, SAF can contribute up to about 65% of the emissions reductions needed to achieve the aviation industry's zero carbon goals.

This assumes a massive increase in production with plans to rapidly increase capacity. The aviation industry is likely to face competition for feedstock for sustainable aviation fuel as other forms of transport look for similar “simple” solutions. Shipping has recently set a target for 2050, with shipping using 300 million tonnes of fuel per year, compared to 176 million tonnes for aviation.

There are significant concerns about the availability of edible raw materials for SAF production and the potential ethical issues if this contributes to global food shortages.

While private sector investment in SAF is increasing, including several airline-backed efforts, significant public funding will be required to meet forecasted demand.

Electric Power

电力驱动

The all-electric Eviation Alice is designed to accommodate nine passengers and two crew members. The prototype took its first - and so far only - flight on September 27, 2022, with test pilot Steve Crane receiving the Experimental Test Pilots Association(Society of Experimental Test Pilots)Iven C Kincheloe Award.(Eviation)

The need for charging could also extend current turnaround times, impacting the business model of low-cost airlines. Replacing a charged battery is currently prohibited because certification rules consider the battery to be part of the aircraft. There is also the issue of how to maintain emergency reserves to cope with regular air traffic control delays and diversions.

Fully electric or hybrid short-haul aircraft are expected to be in service by 2030, but realistically expected services with a range of 1,500 km will only account for 20% of total aviation emissions.

In the most optimistic scenario, electric mobility will have a marginal impact on the 2050 target, with its contribution likely to be tempered by rising electricity supply costs as demand for electric vehicles rapidly expands. Other factors, such as fossil fuel generation undermining green values, and actions such as the ban on short-haul flights in France, could further reduce the substantive contribution to the 2050 target.

Hybrid Power

混合动力

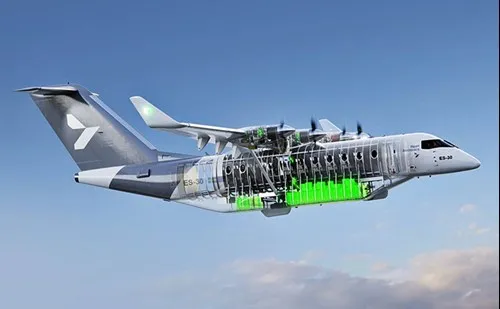

Heart Aerospace of Sweden is developing the ES-30 hybrid 30-seat regional airliner, which is planned to fly 124 miles fully electric, or 247 miles when powered by SAF engines.

Smaller competitors, such as electric vertical take-off and landing aircraft (eVTOL), such as the air taxi service planned for next year's Paris Olympics, will be a boon to those looking for (and able to afford) an alternative to avoiding traffic congestion. It's not a cheap alternative; the upfront cost of each aircraft ranges from $1 million to $4 million, according to the company.《Economist》Even if their operating economics could match existing air and ground alternatives, electric flights would not have much impact on achieving 2050 aviation goals.

Some full-scale demonstration aircraft have been flying for some time, and some manufacturing work has begun. For example, US-based Beta has invested $150 million in facilities and is working to improve battery technology. Other companies are investing in vertical take-off and landing aircraft ports for handling electric air taxis. Overall, however, electric power is not the answer to the 2050 challenge, although it may improve the PR image of the rich and powerful in terms of global emissions counts.

Hydrogen power

氢能

Universal Hydrogen produces conversion kits that can retrofit existing aircraft to enable them to run on hydrogen. The kits consist of a proprietary hydrogen tank module combined with a magniX electric motor and a fuel cell produced by Plug Power. The company's Dash-8 proof-of-concept aircraft made its first flight on March 2, 2023.(Universal Hydrogen)

Hydrogen contains three times the energy of jet fuel and about 200 times more than current lithium batteries. The main disadvantage is that it requires more volume (about four times that of fuel) to store. Current work by Airbus suggests that hydrogen still has the potential to replace fuel in most medium- and long-range aircraft. The company believes these aircraft could be in service by 2030.

However, this means that by 2050, just to keep the UK fleet in the air, between 2 and 4 million tonnes of hydrogen will be needed each year. Current UK hydrogen production is around 700,000 tonnes per year.

Globally, demand will rise to 70 million tonnes by 2050, the total global production in 2022. The broader challenge will be to generate enough sustainable electricity to produce not only hydrogen but also to power the larger electric vehicles that will replace internal combustion engines over the next decade.

A wider societal shift towards hydrogen-based transport systems could have both positive and negative impacts on its use in aviation. The basis for wider demand could lead to investment and, perhaps more importantly, national support for hydrogen production and supply infrastructure. The latter would require significant investment to ensure the delivery of liquid hydrogen to airports to fuel aircraft.

However, competition for this relatively scarce commodity is likely to push up prices, with a corresponding impact on airline operating costs. We will consider the economics of the alternatives, and as with all alternative fuels, the days of cheap flying may be becoming a thing of the past. Green hydrogen is also unlikely to be the preferred source of fuel in the short term, but rather its more environmentally challenging cousin, “blue hydrogen”. This is produced by converting natural gas into hydrogen and capturing the resulting CO2, an approach that still needs to be fully proven at scale.

Optimists believe that by the mid-2030s, the cost of hydrogen fuel will be comparable to that of jet fuel as it becomes more widely used in other forms of transportation and heating. Airbus believes that by 2050, 30% of long-range aircraft will be hydrogen-powered However, full replacement may still be more than 25 years away, and sustainable aviation fuels, with all their flaws, may be the only realistic way to reduce emissions, but may still not meet the 2050 zero-carbon target.

In reality, as Airbus predicts, the future will consist of a mix of sustainable aviation fuels, hydrogen and electric powered aircraft. Even so, this transition will cost billions, if not trillions of dollars worldwide.

Natural hydrogen

自然氢

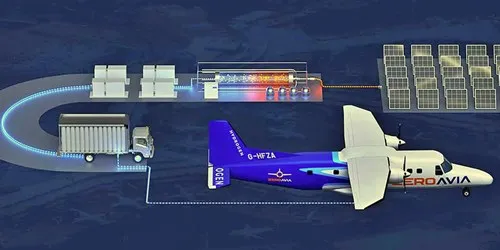

ZeroAvia and Shell are collaborating on the development of the Hydrogen Airport Refueling Ecosystem (HARE). This includes the refueling system and airport pipelines.(ZeroAvia)

It has been suggested that hydrogen may exist in natural reservoirs like natural gas and oil, which, if realized, would alleviate some of the pressure on artificial sources. However, these ideas are still a long way from being proven and simply add another layer of uncertainty about hydrogen availability and cost.《Economist》The report notes that there are more than 1,000 hydrogen projects underway, with investment in production potentially reaching $320 billion by 2030. However, this may not be enough: reaching universal zero-carbon targets may require an additional $380 billion on top of the money already committed to hydrogen production.

The bottom line is that some form of state aid will be necessary to meet the needs of energy-intensive industries, such as cement, which will be a strong competitor to aviation for hydrogen fuel.

This is aided by the trend towards widespread use of hydrogen energy, including heating and ground transportation. By 2050, the infrastructure required for aviation may already be built, although few other applications require the expensive liquefaction process. Other disadvantages include "heat evaporation" (loss of material during transportation and storage), which needs to be addressed by shortening the supply distance.

Aviation impact accelerator

剑桥大学AIA团队

Airbus and ArianeGroup have announced a joint project to build a liquid hydrogen refueling facility for Zero aircraft at Blagnac Toulouse Airport by 2025.(bus)

The World Economic Forum and the AIA (Aviation Impact Accelerator) team at the University of Cambridge have put forward an optimistic view on alternative fuels. They believe that hydrogen fuel cells can be used for electrified medium-distance flights in 2035, pure electric motors will be used for short-distance flights, and hydrogen will be used for long-distance flights. The key assumptions include that lithium batteries will be able to provide a range of 400 kilometers by 2035; by 2050, it will increase to 600 kilometers, which will be the limit of existing battery technology.

Hydrogen fuel cell technology, whose emissions are primarily water, could have some impact on contrail formation. This could be an option for flights up to 2,000 km. Likewise, this could increase to 4,000 km in 2050. Full hydrogen power, which also releases water into the atmosphere and has no other harmful emissions, would be a solution for long-haul flights. However, the report acknowledges that several key stages need to be reached before this future is achieved, and more work needs to be done on mitigating condensation contrails.

The view from the dismal science

悲观科学的观点

A key missing element in the technical debate over reaching the 2050 green target is a comprehensive analysis of the costs and wider economic impacts, and some econometric studies are giving some hints. The first study based on German data suggests that switching to hydrogen could increase airport maintenance and storage costs by up to 17%.

As with other aspects of a "green economy", the transition could have positive benefits for a country's economy, such as training personnel to handle the fuel, which, while it would increase the cost of introducing hydrogen fuel, would be positive from a gross domestic product (GDP) perspective. Overall, the study highlights the complexity of these issues and that aviation should not be viewed in isolation but in light of wider economic and environmental issues.

The second research paper looks at the economics of hydrogen-fuelled aircraft, focusing on direct operating costs, particularly for short-haul and medium-haul flights, arguably the most environmentally challenging area of airline activity. The results suggest that across a range of factors that determine direct operating costs, increases of 11% to 17% are possible. Even more dramatic from an economics perspective for low-cost airlines is turnaround time, which could increase by up to 20%.

Since fuel accounts for approximately 22% of an airline’s direct operating costs, if hydrogen fuel costs 18% more than jet fuel, this will have a significant impact on ticket prices and airline profits.

Competitive dynamics

竞争态势

Where will the new planes come from? Airbus and Boeing are the only possible sources of short- and medium-haul airliners that can meet green targets. Sustainable Aviation Fuel (SAF) projects are clearly the easiest path, but are susceptible to all the caveats detailed earlier. The radically different concept would require about $30 billion and a decade to roll out and enter service—not to mention the years needed to replace the global fleet.

Airbus has taken the first step but has not yet decided whether to launch a hydrogen-powered “A390”. Boeing faces financial problems and needs to maintain shareholder value and meet internal financial targets, which may not be compatible with high-risk investments. Without commercial pressure from Boeing, Airbus may not have the motivation to launch a radically different alternative on its own.

Conclusions

总结

Although NASA's X-57 Maxwell conducted ground operation tests, the project was abandoned in June 2023. The agency cited the immaturity of electric propulsion technology as the main reason for the cancellation. (NASA)

26 years closer to a zero-carbon aviation system, where do we stand?

In short, while there are internationally agreed targets and two important political entities, the United States and the European Union, have pledged R&D funding to work on technical solutions, action remains largely concentrated in individual national governments. Efforts are also being driven by the work and commercial interests of the two major aircraft companies (Airbus and Boeing), China, which represents a large part of the market, and the three engine companies. Investment needs on the ground and in the air could cost billions of dollars to develop the equipment and infrastructure to achieve zero-carbon targets.

In the Sustainable Aviation Fuel (SAF) pathway, while one of the simplest, it is not a complete solution to emissions and there are a number of unknowns, including issues with scaling up production, competition from other industries, and potential ethical issues with impacts on food supply. Adoption of hydrogen fuel will require the largest investment in infrastructure and aircraft development, and there are more unknowns about the impact on the broader shift to a hydrogen-powered future. The costs and prices (and therefore the impact on aviation demand) estimated by the “science” of econometrics range from significant to more significant.

Ideally, if this were a global problem, with targets set by international organizations, we should see more international cooperation to set standards and agree on common solutions, thereby launching projects to create the necessary technical answers and build new air transport infrastructure, while assisting poor countries to gradually adapt and achieve a carbon-neutral air transport system.

However, as things stand, there has not been much progress in this direction. Overall, we agree with Akbar Al Baker on the likelihood of achieving the ambitious 2050 targets, that there seems to be “all talk and no action” among aviation executives, and that we in the aviation industry may still be behaving like Mr Micawber in Dickens’ novel, “spending our lives hoping for a miracle”, to borrow a metaphor.