The exciting but challenging road to sustainable aviation development

Alix Partners Managing Directors Pascal Fabre and Michele Mauri, along with James Ellis, Douglas McIvor and Matteo Peraldo, reflect on what the aerospace industry needs to do to deliver on its sustainability commitments.

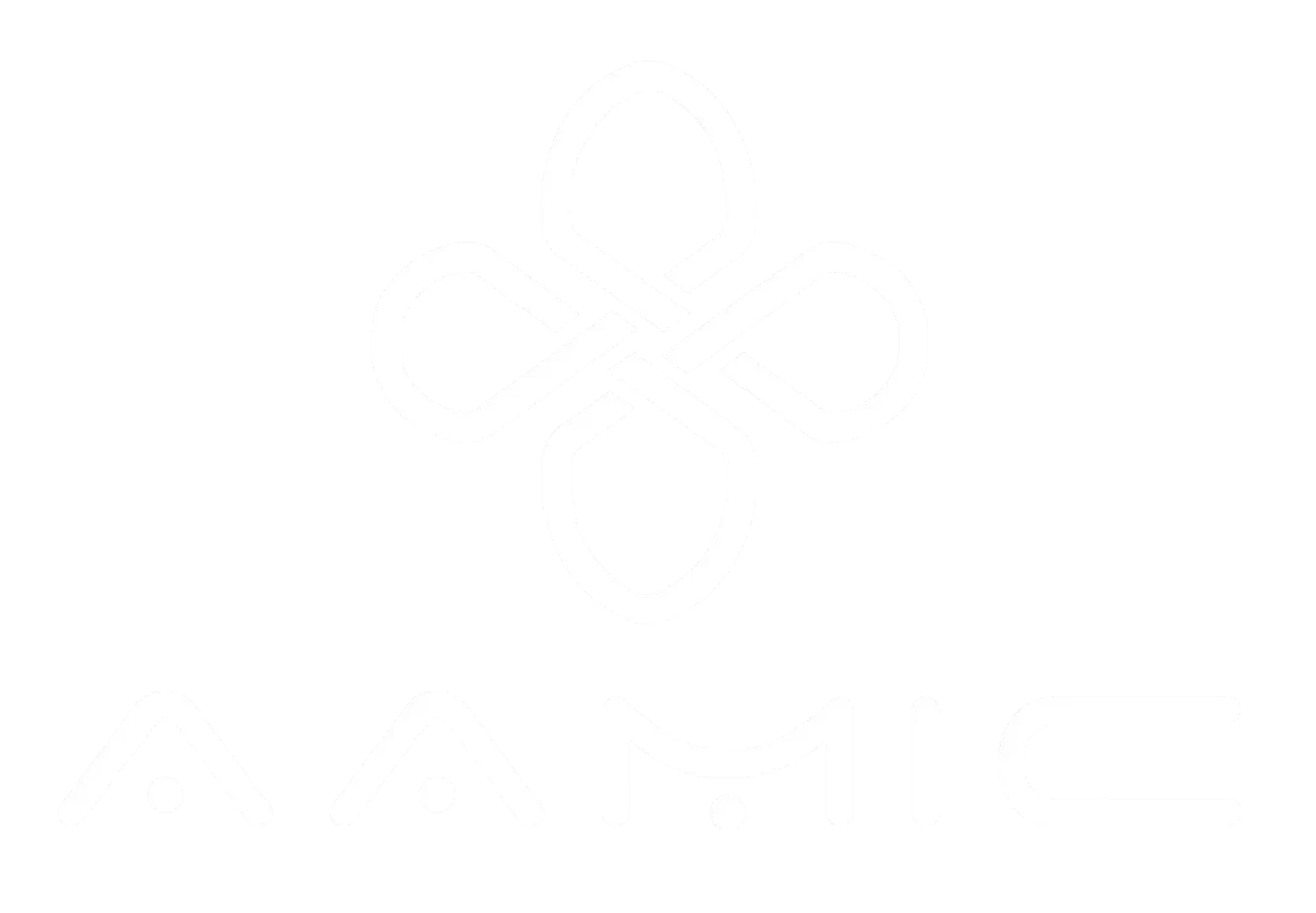

As the global aviation industry recovers from the global pandemic, the focus has shifted to accelerating the future of aviation and the critical topic of sustainable development. Last year, at the 2021 IATA Annual Meeting, the aviation industry once again proposed a plan to reduce emissions by 2050. This goal is in line with the Paris Agreement. The Paris Agreement plans to achieve net zero carbon emissions by 2050 and limit global temperature rise to below 1.5 degrees Celsius by 2100.

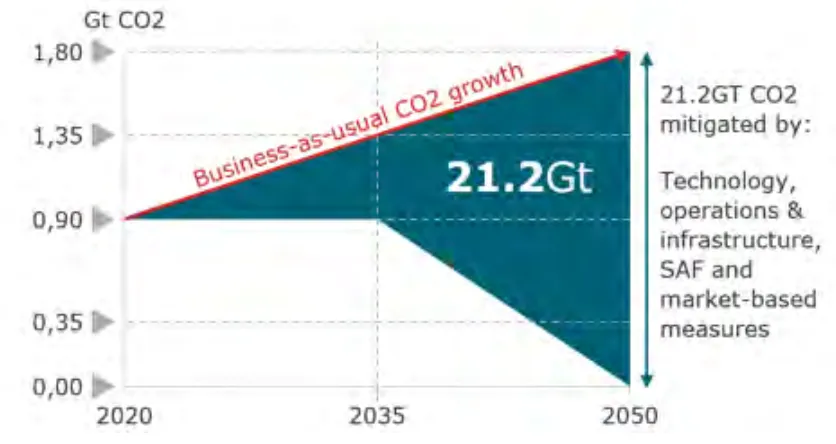

The global aviation industry generated 900 million tonnes of carbon emissions in 2019. In the past few years, commercial air traffic has grown nearly four times faster than improvements in fuel efficiency, and even taking into account the impact of the pandemic, passenger traffic is expected to double every 20 years until 2050.

Although the aviation industry has made significant progress in improving efficiency over the past few decades, with a maximum efficiency improvement of 15-20% with each new generation of aircraft approximately every 20 years, the pace will need to be accelerated to achieve ambitious emissions reduction targets in the future.

As one of the world's top five countries with aerospace export markets and the source of some of the largest and most important original equipment manufacturers and suppliers in the value chain, the UK plays a key role in driving carbon reduction across the industry. Along with route investment, the UK government has also begun to formulate its own "Jet Zero" strategy to meet the "2050 target".

Given the scale of future work, the research and development, application, implementation and industrialization of new technologies will play a vital role in achieving the "2050 Goals".

Existing aircraft and engine programs are reaching maturity, and next-generation approaches for commercial and defense aviation are in the development phase to ensure product iterations into the 2030s and beyond. The path forward will require the exploration of all viable technology pathways, some existing and some emerging, coupled with significant investment to help make them a reality.

World Energy has announced plans to transform its existing facility in Houston into a sustainable aviation fuel hub with the capacity to produce 250 million gallons of cleaner jet fuel annually starting in 2025.

Questions to be answered

The challenges ahead are filled with unanswered questions:

What are the available pathways to decarbonize aviation?

What game-changing technologies will emerge?

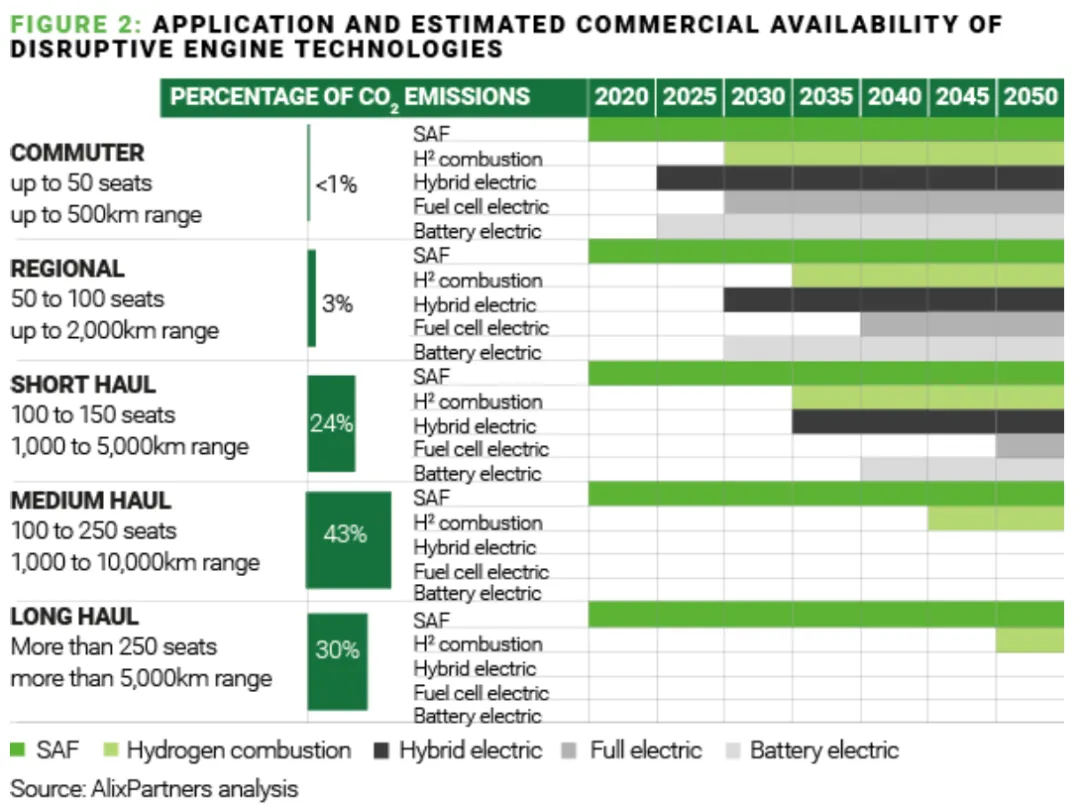

What is the time frame for the introduction of these technologies and will they impact all route structures, from commuter to long-haul?

Will the government enforce a roadmap to net zero emissions through incentives and/or mandates for emissions?

In an environment of rising interest rates, increasing debt across the aerospace value chain and increasing government defense spending, who will finance the massive investments required?

Moving forward, five key areas come into focus, each of which can significantly contribute to the aviation decarbonization roadmap.

Earlier this year Airbus described final assembly of the EcoPulse demonstrator as 'progressing well, paving the way for first test flights later this year'. Based on the Daher TBM, the aircraft features six distributed electric propulsion units and a new high-voltage lithium-ion main battery system.

Fleet Renewal

Fleet renewal is the easiest way for airlines to reduce carbon emissions. Replacing an older fleet with the latest generation of aircraft can bring a 15-20% improvement in fuel consumption. Currently only about 20% of the widebody and narrowbody fleet is the latest generation of aircraft, but the pace of fleet renewal will accelerate as we move towards 2030.

However, as airlines weigh passenger market recovery, the unknown new normal of air travel, funding sources and priorities, and the emergence of new breakthrough technologies that can be used to extend fleet renewal cycles, they continue to face difficult decisions about the scope, timing and aircraft type of fleet renewal.

However, this avenue is limited by the current post-pandemic financial situation of airlines and will likely result in further market share gains by aircraft lessors.

Airbus and Air New Zealand have signed a memorandum of understanding to research hydrogen-fuelled aircraft, while Airbus will work with Air Liquide and airport operator Vinci to focus on hydrogen aviation infrastructure by 2030.

Improved flight and ground handling

CO2 emissions could be reduced by up to 12% through better operational arrangements, such as shorter routes, lower altitudes, formation flying and the Continuous Descent Approach (CDA). This target could be achieved in the medium term if there is agreement between the relevant regulators, but relevant programmes, such as NextGen and Single European Sky in the US, are extremely complex and have been slow to deploy.

Further improvements can be achieved by reducing fuel-related emissions on the ground, for example by switching to electric and hydrogen technologies. The key to success is to provide sufficient charging facilities and reserves for ground equipment to support efficient operations and maintain aircraft turnaround times. Operational challenges, in addition to turnaround efficiency, include ensuring power supply at the point of use, battery/hydrogen operation, safety issues and technical stability in the event of failures.

The Boeing TTBW prototype will have an ultra-thin wing with a span of 170 feet, supported by a truss that provides lift.

Sustainable Aviation Fuel (SAF)

Maximum Achievable Emissions Reduction (MAER): Up to 55%; Timeframe: Now to 2030; Scope: Requires large-scale production, after which production will be fixed by demand visibility; Can be retrofitted on existing technology.

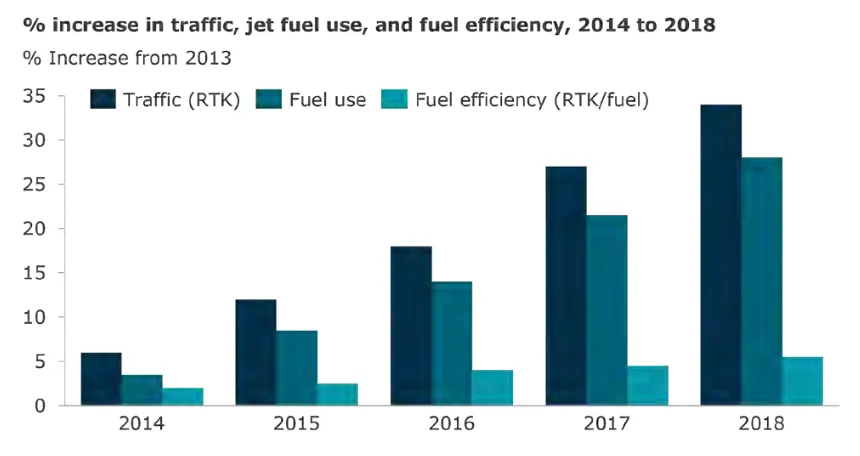

SAF is not only the simplest possible option, but can be a real game changer. In most cases, it is a straightforward solution that can be implemented with existing airport infrastructure and limited aircraft/engine modifications, and blends of 50% SAF are already certified. SAF comes in the form of biofuels, derived from biological or renewable resources (such as waste oils or agricultural residues) or synthetically produced. Airbus and Boeing aim to have commercial aircraft (and Airbus Helicopters) certified to run on 100% SAF by 2030.

To be widely successful, SAF needs to be produced in large quantities and its price to fall—it currently costs three to five times the price of Jet A1. With commercial certification now in place, SAF use is growing, but still accounts for less than 0.1% of total jet fuel consumption. In Europe, a minimum percentage of SAF in jet fuel has been voted in, which will soon force airlines to invest in massive industrial capacity, creating demand to reduce unit costs. The United States has taken a different path, offering tax incentives to favor SAF use. The United Kingdom aims to have at least 10% SAF in jet fuel by 2030 and at least five SAF plants in operation by 2025.

Aircraft Technology

In the medium to long term, new aircraft technologies and architectures can significantly reduce CO2 emissions, while aerodynamic optimization and the use of new-generation materials can also reduce CO2 emissions in a gradual manner.

Solution 1: New airframe shape and construction. MAER: 20%; Timeframe: 2045+; Scope: Widebody - Long Range; Not retrofittable on existing technology.

Both major aircraft manufacturers have proposed conceptual studies of a blended wing-body design, which is considered one of the most promising options so far. The transonic truss braced wing (TTBW) proposed by Boeing is another option. However, this option faces obstacles in terms of existing airport and traffic management infrastructure, as these facilities are designed for aircraft with typical configurations, which means that the implementation of this option will take more time.

Solution 2: Optimize aerodynamics. MAER: 6%+; Timeframe: now to 2030+; Scope of application: wide; some can be retrofitted and upgraded based on existing technologies.

Further optimization of aerodynamics through new technology aircraft (including laminar flow in the wing, aeroelastic aspects of the wing configuration, and active aerodynamic flow control) may only provide incremental improvements in fuel consumption, but at the same time increase operational complexity.

Solution 3: Next-generation materials and composites. MAER: 2%; Timeframe: Now to 2030; Scope: All aircraft types and mission profiles; Not retrofittable on existing technologies.

Composite materials can reduce weight by 20%, which has a significant impact on fuel consumption. Complex materials with the lowest density (such as CFRP) already account for more than 50% of the weight on the B787 and A350 - a huge improvement compared to 1-2% on the B747 and 10% on the B777.

Is the era of light aviation coming? Beam's EV-ARC solar-powered electric vehicle charger can be moved from one airport to another and used in airplanes and cars.

Propulsion Technology (Next Generation Jet Engines)

Engine OEMs are driving performance-focused improvements to traditional jet engines, as well as new configurations, including geared turbofans, higher compression ratios, higher bypass ratios, smaller cores, advanced materials and propfan (open rotor) concepts. Nearly 40% of the new generation of narrow-body engines launched to the market in the past five years use Pratt & Whitney's geared turbofan technology. CFM International has just launched an open rotor engine program called RISE, which makes full use of hydrogen and is expected to reduce fuel consumption by 20% compared to today's turbofan engines. The main challenges of these solutions are airframe flexibility and ground clearance requirements, maintenance, repair and operation (MRO) requirements and cost, speed and noise impacts.

Propulsion technology (liquid hydrogen combustion)

Hydrogen is a very energy-dense fuel that can replace jet fuel in conventional engines with limited engine modifications. It is lighter than jet fuel, but hydrogen requires about four times the volume - an obvious challenge for aircraft construction and the location of the fuel tanks on the aircraft. Other obstacles include engineering challenges, building an ultra-cold fuel distribution system on the aircraft to obtain hydrogen in ultra-cold tanks and deliver it to the engines, as well as the huge storage space and distribution infrastructure required at airports. There are also challenges in production, as only 0.1% of global hydrogen production is carbon-free or "green hydrogen". Airbus leads the industry and plans to put hydrogen-powered aircraft into service by 2035.

Propulsion technology (batteries)

As technology matures in the automotive industry, the battery sector is attracting significant investment and attention from the aviation industry.

The main advantages include highly efficient, low-noise electric powertrains, however, the energy density of current industrial batteries is low, which adds significant weight and greatly limits the scope of application and use scenarios. There have been several successful test flights and many new projects covering commuter aircraft, including modification of existing platforms, as well as new electric aircraft. Another hot part of air mobility is electric vertical take-off and landing (eVTOLs), the first aircraft has been certified (Pipistrel in 2020) and usually has less than 19 passengers. Several small regional aircraft projects are also on the horizon, with the goal of entering service between 2020-30.

German startup Volocopter recently conducted a flight at the state-of-the-art air mobility test vertical takeoff and landing airport in Rome Fiumicino, Italy, demonstrating a future service between the airport and the city of Rome.

Propulsion technology (all-electric/fuel cell)

Fuel cells have advantages over battery power, but their first possible commercial applications are not expected until 2035-2040. Hydrogen fuel cells present specific challenges, including the development of durable aerospace-grade fuel cells and their performance and durability may limit long-term applications.

Propulsion technology (hybrid)

Combining conventional turbofans with electric engines can reduce emissions by optimizing the engine technology choices during flight. The electric engine (battery or fuel cell powered) can provide power during takeoff and climb, which allows the gas engine to be smaller, lighter and optimized for cruise flight. Several electric and gas engine combinations are currently under development, which could bring electrification to larger commercial aircraft, making it more realistic than achieving full electric propulsion.

Airbus has announced plans to use a modified A380 as a test bed to test hydrogen fuel technology. It has partnered with CFM International, a joint venture between General Electric and Safran Aircraft engines.

Working together

The automotive industry has been forced onto an accelerated and very expensive path of decarbonization due to strong government regulation and high fines for fleet emission levels. The aviation industry, research institutions, governments, finance and the energy sector urgently need to work together to avoid a similar situation. The SDGs will consume huge resources and time, and achieving them will require a huge change in mentality.

The path to sustainable aviation will be very expensive and challenging, requiring support from governments in terms of funding for research into new technologies and incentives for regulatory frameworks or mandates for increased production of sustainable aviation fuels or hydrogen infrastructure. This could also lead to more expensive air travel in the medium term.

SAF development and fleet renewal are two cornerstones of the challenging aviation decarbonization roadmap to net zero emissions by 2050. All players in the aviation ecosystem and value chain, both traditional and emerging, must think ahead and articulate clear strategies before it is too late to adapt. This becomes even more challenging as the industry continues to face the impact of ongoing growth and recovery, labor shortages, cost inflation and supply chain disruptions/constraints.

Traditional Enterprises

For traditional aerospace companies, original equipment manufacturers and suppliers, they must master several key success factors to ride this new wave.

Strategy and operating model: Preparing for sustainable aviation means understanding all aspects of a business’s business model, including the impact on footprint, people, suppliers and technology delivery.

Investment: For the right technology and based on proven commercial viability

Prudent capital management: balancing current operational pressures by prioritizing investments to develop next-generation technologies and make them a reality through technology industrialization (e.g., R&D, engineering approaches).

Leverage partnerships: Work with agile startups to accelerate R&D and cover capability gaps. Ensure collaborative mechanisms with clear goals and target setting are in place to leverage partners’ potential.

Focus on talent and critical skills: Manage and retain the talent needed to achieve advancement. Identify new and growing skills (e.g., software, cybersecurity) required to meet demand and ensure the talent pipeline exists with long-term retention mechanisms.

Supply chain: redesign and increase capacity at competitive costs.

A clear digital roadmap: Detailed transformation requires changes in development, delivery technology, and operating models.

A systems approach: focusing not only on aircraft, platforms and engines, but also on the aviation ecosystem as a whole (infrastructure, airports, fuel, etc.).

A change in mindset: Treat this as an unmissable opportunity to play a new role in the value chain, obtain funding from third-party investors, and as a business development initiative.

Emerging Companies

For emerging players, while the success factors will be quite different, securing the right talent and expertise will be a key common theme:

Focus not only on technology: business model, operating model also need to be considered, as well as the choice of manufacturing, cooperation or purchase. The first flight is just the beginning, not the end.

Ensure the DTC (design-to-cost) principle as early as possible at the beginning of development: embed the goal of modularization and large-scale production from the beginning when the degree of freedom is relatively high. Digital design, manufacturing and operation are the competitive advantages for entering the large-scale market.

Locking in funding sources: The journey from obtaining certification to finally putting it into operation is a long and expensive process.

Further downstream in the value chain, airlines, airports and service providers also need to understand how new modes of transport will affect their business and operating models, and identify threats and opportunities to guide the adjustments that need to be made to their business and operating models.

All players in the industry must continue to accelerate development with a clear and targeted roadmap and a portfolio of solutions that are efficient, reliable, safe, economical and operate in a sustainable manner. The road to a truly sustainable future for aerospace will be long, expensive, and challenging – but it is also, at its core, critical and exciting.

This article is excerpted from the Royal Aeronautical Society's "Aerospace" November 2022 issue

Translation: Wu Zhengqi